The fuel delivery software comparison landscape has transformed dramatically over the past few years. Enterprise buyers now face a critical decision: invest in ready-made SaaS solutions or develop custom fuel delivery software tailored to their unique operational needs? This comprehensive guide examines both approaches, backed by real market data and critical hardware integration insights, to help you make an informed decision for your fuel delivery business.

Understanding the Fuel Delivery Software Market Landscape

The global fuel delivery management system market reached $8.2 billion in 2023 and is projected to grow at a CAGR of 12.4% from 2024 to 2030, according tostrategic market research. This explosive growth is driven by increasing demand for on-demand services, fleet optimization needs, and the push toward digitalization in traditional fuel distribution businesses.

Enterprise buyers in North America, particularly in the USA and Canada, are leading this digital transformation. Companies like Booster Fuels, EzFill, and Yoshi have demonstrated that technology-driven fuel delivery can capture significant market share from traditional gas stations.

| Market Metric | 2023 Value | 2030 Projection | Growth Rate |

|---|---|---|---|

| Global Market Size | $8.2B | $18.7B | 12.4% CAGR |

| North America Share | 38% | 42% | Leading Region |

| Mobile App Penetration | 62% | 89% | Key Driver |

| Enterprise Adoption | 45% | 71% | Fastest Growing |

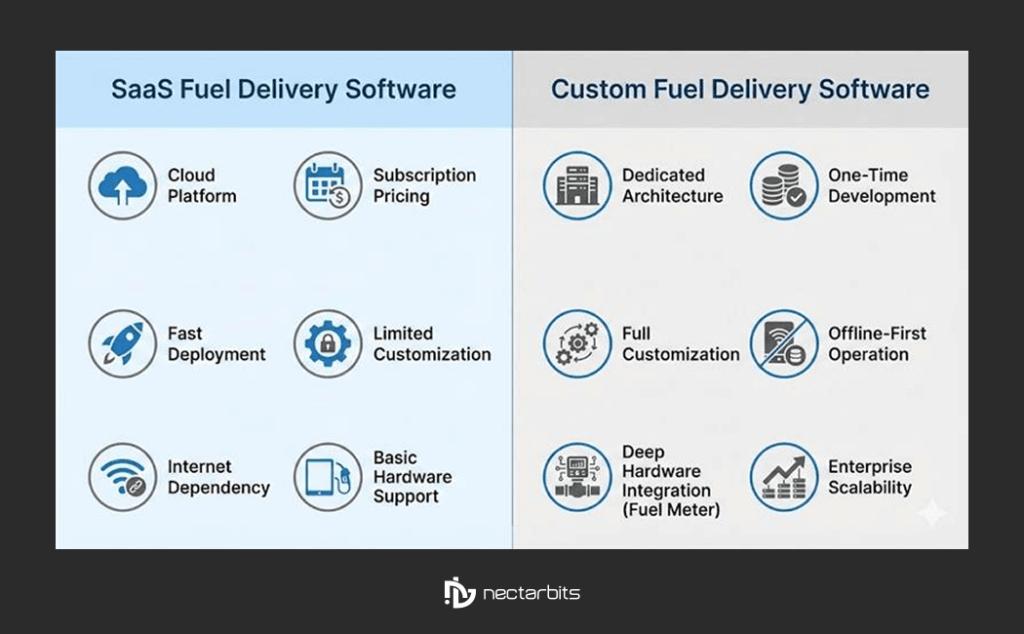

What is SaaS Fuel Delivery Software?

SaaS Fuel Delivery Solutions are pre-built, cloud-based platforms that provide standardized fuel delivery management capabilities. These solutions operate on a subscription model where businesses pay monthly or annually for access to the software infrastructure.

Key Characteristics of SaaS Solutions

Multi-Tenant Architecture: Multiple companies share the same software instance with data segregation, allowing providers to maintain one codebase for all customers.

Rapid Deployment: Most SaaS platforms can be deployed within 2-6 weeks, enabling businesses to start operations quickly without extensive development cycles.

Standardized Features: Core functionalities include order management, driver tracking, payment processing, and basic analytics—features that work for the majority of fuel delivery businesses.

Predictable Costs: Subscription pricing typically ranges from $299 to $1,500 per month for small to mid-sized operations, with enterprise tiers reaching $5,000+ monthly depending on transaction volumes and user counts.

Connectivity Dependency: Most SaaS platforms require continuous cloud connectivity for real-time operations. This can present challenges when drivers operate in areas with poor cellular coverage, such as remote construction sites, underground parking facilities, or rural agricultural locations.

What is Custom Fuel Delivery Software?

Custom fuel delivery software is built from the ground up by a custom software development company specifically for your business requirements. This approach involves comprehensive planning, design, development, and deployment phases tailored to your unique operational workflows.

Key Characteristics of Custom Solutions

Bespoke Architecture: The entire system is designed around your specific business processes, existing infrastructure, and future scalability requirements.

Complete Control: You own the intellectual property and source code, and have full authority over feature development, data management, and system modifications.

Hardware Integration Capabilities: Custom solutions can build direct integrations with specialized fuel delivery hardware, including Electronic Meter Registers (Liquid Controls LCR-II, TCS 3000), proprietary pumping systems, tank monitoring sensors, and legacy equipment that SaaS platforms may not support.

Offline-First Architecture: Custom development enables true offline functionality where the driver’s tablet stores all critical data locally—pricing, customer information, routing logic, and transaction records. The system operates fully without connectivity and automatically syncs when the signal is restored, preventing operational paralysis in remote areas.

Scalability on Your Terms: As your business grows, the software can evolve without being constrained by a vendor’s roadmap or pricing tiers.

| Development Phase | Timeline | Key Deliverables | Investment Range |

| Discovery & Planning | 2-4 weeks | Requirements doc, hardware integration specs | $5,000-$15,000 |

| Design & Prototyping | 3-5 weeks | UI/UX designs, offline architecture design | $10,000-$25,000 |

| Core Development | 12-18 weeks | Backend, admin panel, APIs, hardware drivers | $60,000-$150,000 |

| Mobile Apps | 8-12 weeks | iOS and Android apps with offline-first logic | $40,000-$100,000 |

| Testing & QA | 4-6 weeks | Hardware integration testing, offline scenarios | $15,000-$30,000 |

| Total Custom Build | 6-9 months | Complete ownership | $130,000-$320,000 |

Critical Hardware Integration: The Electronic Register Connection

One of the most significant differences between SaaS and custom solutions lies in how they handle the hardware backbone of fuel delivery operations—the Electronic Meter Register.

The Shrinkage Problem: Why Hardware Integration Matters

Enterprise fuel delivery operations face a critical challenge that generic software discussions often overlook: fuel theft and shrinkage. When software doesn’t integrate directly with the truck’s Electronic Meter Register (such as Liquid Controls LCR-II or TCS 3000 systems), drivers must manually enter gallons pumped into the system.

This manual entry creates a vulnerability. A driver could pump 500 gallons but enter only 450 gallons into the system, pocketing the difference through unauthorized sales or internal theft. For enterprises handling hundreds of daily deliveries, even small discrepancies compound into substantial losses.

The Hardware Handshake: Custom Integration Advantage

SaaS Platform Approach: Most SaaS platforms rely on manual gallon entry by drivers due to the complexity and cost of supporting diverse meter hardware across their customer base. This creates audit gaps and requires extensive reconciliation processes.

Custom Solution Approach: Custom fuel delivery software can build direct serial or Bluetooth connections with Electronic Registers. The invoice generation is triggered automatically based only on what the meter actually dispensed—no manual entry, no opportunity for discrepancy. The system captures:

- Exact gallons pumped from the meter

- Pump start and end times

- Flow rate data for quality verification

- Meter seal status and tamper detection

- Real-time discrepancy alerts if system data doesn’t match meter readings

This “hardware handshake” virtually eliminates internal fuel theft and dramatically reduces reconciliation time. According to Mexico’s state oil, fuel theft costs the industry approximately $1.5 billion annually in North America, making direct meter integration a critical ROI driver for enterprises.

| Hardware Integration Aspect | SaaS Capability | Custom Capability |

| Electronic Register Support | Limited or none | Native LCR, TCS integration |

| Data Entry Method | Manual by the driver | Automatic from the meter |

| Theft Prevention | Audit trails only | Real-time meter verification |

| Hardware Compatibility | Standard devices only | Legacy and proprietary systems |

| Installation Complexity | Simple tablet mount | May require hardline integration |

Deep Dive: Fuel Delivery Software Features Comparison

Understanding which fuel delivery software features matter most for your enterprise helps clarify the SaaS versus custom decision. Let’s examine critical functionality across both approaches.

Core Operational Features

Order Management Systems: Both SaaS and custom solutions handle order intake, scheduling, and fulfillment tracking. However, custom solutions can incorporate unique order prioritization algorithms based on your specific business rules—such as prioritizing high-volume commercial accounts or integrating with existing ERP systems.

Real-Time GPS Tracking: Standard in SaaS platforms, GPS tracking shows driver locations and estimated arrival times. Custom solutions can add sophisticated features like dynamic route optimization based on real-time traffic, fuel price fluctuations, or driver performance metrics specific to your KPIs.

Automated Dispatch: SaaS platforms offer basic automated dispatch based on proximity and availability. Custom systems can implement complex dispatch logic considering driver expertise, vehicle fuel capacity, customer relationships, regulatory restrictions, and even weather conditions.

Read More: How Automated Dispatching Solves Fuel Delivery Chaos →

Connectivity Resilience: The Offline-First Imperative

Enterprise fuel delivery operations cannot afford to stop because of poor cellular signal. Fuel trucks regularly operate in connectivity dead zones:

- Construction sites with limited tower coverage

- Underground parking facilities and loading docks

- Rural farms and agricultural operations

- Industrial complexes with signal interference

- Remote oil fields and mining operations

SaaS Limitations: Most cloud-dependent SaaS platforms struggle when connectivity drops. Drivers cannot complete deliveries, print tickets, process payments, or capture signatures without an active connection. This leads to delayed transactions, frustrated customers, and drivers waiting for the signal to return.

Custom Offline-First Architecture: Custom solutions can implement true offline functionality where all critical data resides locally on the driver’s tablet:

- Complete customer database with pricing and credit terms

- Routing information and delivery instructions

- Product catalog and current inventory levels

- Tax calculation engines for all jurisdictions

- Invoice generation and digital signature capture

- Payment processing with delayed settlement

The system operates at 100% capacity offline and intelligently queues all transactions for automatic synchronization once connectivity is restored. This architectural approach prevents operational paralysis and ensures continuous service delivery regardless of signal strength.

| Feature Category | SaaS Capability | Custom Capability | Enterprise Impact |

| Order Processing | Standard workflows | Business-specific logic | Medium-High |

| Route Optimization | Basic algorithms | AI-driven, multi-variable | High |

| Offline Functionality | Limited or none | Full offline-first operation | Critical |

| Payment Integration | 5-10 preset gateways | Unlimited integrations | Medium |

| Hardware Integration | Generic devices | LCR, TCS, proprietary meters | Very High |

| Reporting & Analytics | Pre-built dashboards | Custom KPI tracking | Very High |

| Regulatory Compliance | General frameworks | Jurisdiction-specific engines | Critical |

Advanced Tax Engine: Beyond Basic Compliance

One of the most complex aspects of fuel delivery that generic software discussions oversimplify is taxation. Enterprise operations don’t just need “compliance”—they need sophisticated, automated tax engines.

The Multi-Layer Tax Challenge: Fuel delivery involves multiple simultaneous tax layers that vary by precise delivery location:

- Federal excise taxes

- State or provincial fuel taxes

- County and municipal taxes

- LUST (Leaking Underground Storage Tank) taxes

- Environmental and spill taxes

- Special district taxes (airports, ports, reservations)

SaaS Approach: Most SaaS platforms apply flat tax rates configured manually for broad regions. This creates significant audit risk when delivering to locations with special tax status—Native American reservations, federal buildings, tax-exempt organizations, or specific industrial zones.

Custom Tax Engine: Custom solutions can implement dynamic tax calculation based on precise GPS coordinates at the delivery point. The system automatically:

- Determines all applicable tax jurisdictions for the exact delivery location

- Applies correct rates for each tax layer

- Generates jurisdiction-specific documentation

- Maintains audit trails for tax authority inquiries

- Updates rates automatically when regulations change

IFTA Automation: Cross-Border Complexity

For enterprises operating across multiple states or provinces, IFTA (International Fuel Tax Agreement) reporting represents a major administrative burden. IFTA requires detailed reporting of miles driven in each jurisdiction to calculate appropriate tax liability.

Manual IFTA Process: Without automation, accounting teams spend hundreds of hours quarterly reconstructing driver routes, calculating mileage by jurisdiction, and preparing multi-state reports.

Automated IFTA in Custom Software: Custom fuel delivery platforms can track precisely how many miles were driven in each jurisdiction using GPS data, automatically generating IFTA reports with supporting documentation. This saves enormous administrative time and reduces audit risk from calculation errors.

| Compliance Feature | SaaS Approach | Custom Approach |

| Tax Calculation | Flat rates by region | Dynamic geocoordinate-based |

| Tax Layers Supported | 1-3 basic taxes | Unlimited simultaneous taxes |

| Special Jurisdiction Handling | Manual configuration | Automatic detection |

| IFTA Reporting | Manual or basic export | Fully automated with GPS data |

| Audit Trail Depth | Transaction logs | Complete geocoded documentation |

| Regulatory Updates | Vendor schedule | Immediate custom implementation |

Fuel Delivery App Development Cost Analysis

Understanding the complete cost structure is essential for enterprise buyers. The fuel delivery app development cost extends far beyond initial development or subscription fees.

SaaS Total Cost of Ownership (3 Years)

Subscription Fees: For an enterprise handling 500 daily deliveries, expect to pay approximately $3,500-$6,000 monthly for a robust SaaS platform, totaling $126,000-$216,000 over three years.

Transaction Fees: Many SaaS providers charge per-transaction fees ranging from $0.15 to $0.75 per delivery. At 500 deliveries daily (approximately 180,000 annually), this adds $27,000-$135,000 annually or $81,000-$405,000 over three years.

Integration Costs: Connecting SaaS platforms to existing systems (ERP, accounting, CRM) typically requires middleware or custom API development, costing $15,000-$40,000 initially plus ongoing maintenance.

Customization Fees: Even minor customizations on SaaS platforms can cost $5,000-$25,000 per modification, and some changes may not be possible at all.

Data Extraction Fees: A hidden cost that catches many enterprises by surprise—if you decide to migrate away from a SaaS provider, extracting your complete historical data in usable formats often incurs substantial fees. Some providers charge $10,000-$50,000 for comprehensive data exports, creating significant vendor lock-in beyond just the migration effort.

| SaaS Cost Category | Year 1 | Year 2 | Year 3 | 3-Year Total |

| Platform Subscription | $42,000-$72,000 | $42,000-$72,000 | $42,000-$72,000 | $126,000-$216,000 |

| Transaction Fees | $27,000-$135,000 | $27,000-$135,000 | $27,000-$135,000 | $81,000-$405,000 |

| Integration & Setup | $25,000-$50,000 | $5,000-$10,000 | $5,000-$10,000 | $35,000-$70,000 |

| Customizations | $10,000-$30,000 | $10,000-$20,000 | $10,000-$20,000 | $30,000-$70,000 |

| Data Extraction (exit) | $0 | $0 | $15,000-$50,000 | $15,000-$50,000 |

| Total SaaS TCO | $104,000-$287,000 | $84,000-$237,000 | $99,000-$287,000 | $287,000-$811,000 |

Custom Development Total Cost of Ownership (3 Years)

Initial Development: A comprehensive custom fuel delivery platform, including web admin, driver app, customer app, and hardware integrations, typically requires an investment of $130,000-$320,000, depending on feature complexity and development team location.

Hosting & Infrastructure: Cloud hosting on AWS or Azure for an enterprise-scale fuel delivery operation costs approximately $800-$2,500 monthly or $28,800-$90,000 over three years.

Maintenance & Updates: Annual maintenance typically runs 15-20% of initial development cost, or approximately $19,500-$64,000 annually ($58,500-$192,000 over three years).

Team & Support: Whether building an in-house team or maintaining a relationship with your development partner, budget for ongoing support costs of $3,000-$8,000 monthly or $108,000-$288,000 over three years.

| Custom Cost Category | Year 1 | Year 2 | Year 3 | 3-Year Total |

| Development | $130,000-$320,000 | $0 | 0 | $130,000-$320,000 |

| Hosting & Infrastructure | $9,600-$30,000 | $9,600-$30,000 | $9,600-$30,000 | $28,800-$90,000 |

| Maintenance & Updates | $19,500-$64,000 | $19,500-$64,000 | $19,500-$64,000 | $58,500-$192,000 |

| Support & Enhancements | $36,000-$96,000 | $36,000-$96,000 | $36,000-$96,000 | $108,000-$288,000 |

| Total Custom TCO | $195,100-$510,000 | $65,100-$190,000 | $65,100-$190,000 | $325,300-$890,000 |

Read More: Compare Custom vs. Readymade Solutions →

Cost Comparison Insights

At first glance, SaaS appears more affordable in Year 1. However, the cumulative effect of subscription and transaction fees means that by Year 3, total costs can approach or exceed custom development investments. When factoring in data extraction fees and vendor lock-in costs, the gap narrows even further. More importantly, with custom software, you own an appreciating asset, while SaaS represents pure operational expense with no equity building.

Break-Even Analysis: For enterprises processing 300+ daily deliveries, custom solutions typically reach cost parity with SaaS platforms between 18-28 months. Beyond this point, custom solutions deliver significantly better ROI while providing complete control and unlimited scalability.

The Hybrid Strategy: Best of Both Worlds

The fuel delivery software comparison doesn’t have to be purely binary. A growing number of enterprises are adopting a sophisticated middle-ground approach that combines SaaS infrastructure with custom differentiation.

Headless SaaS with Custom Frontend

This architectural approach leverages a robust SaaS backend for proven dispatch logic and infrastructure management while building a completely custom mobile application layer for customer-facing experiences.

The Strategy: Use a SaaS platform’s APIs for the “boring but critical” functions—dispatch algorithms, basic route optimization, driver management, and infrastructure reliability. Simultaneously, invest in a purely custom mobile application that delivers your unique brand experience, proprietary features, and competitive differentiation.

Benefits:

- Reduced infrastructure management burden

- Faster time to market than full custom development

- Complete control over customer experience and brand

- Ability to switch backend providers without changing the user experience

- Lower initial investment than a full custom build

Ideal For: Enterprises that value brand differentiation and unique customer experiences but want to minimize backend infrastructure complexity. This works particularly well for companies with a strong brand identity entering the fuel delivery market.

Investment Profile: Expect $60,000-$120,000 for Custom Mobile App development plus ongoing SaaS subscription fees. This represents a middle ground between pure SaaS and full custom development.

Specialized Operations: Bulk Drop vs. Wet-Hosing

Enterprise fuel delivery encompasses diverse operational models that require different software capabilities. Understanding these distinctions helps clarify which approach—SaaS or custom—better serves your specific business model. Implementing the right enterprise fuel delivery software ensures operational efficiency and accurate reporting across all delivery types.

Bulk Drop Operations

Bulk drop involves filling large stationary tanks at single locations—gas stations, commercial facilities, agricultural operations, or industrial sites. This represents the more straightforward delivery model that most SaaS platforms handle adequately.

Software Requirements:

- Single customer account per delivery

- One meter reading per transaction

- Standard invoicing and ticketing

- Basic compliance documentation

Wet-Hosing and Fleet Fueling Complexity

Wet-hosing (also called fleet fueling) involves fueling multiple individual vehicles within a single location—construction equipment yards, trucking depots, municipal vehicle facilities, or corporate fleets. This operational model presents significant software complexity that many SaaS platforms struggle to handle efficiently.

The Challenge: A single delivery run might involve fueling 50 different vehicles under one master purchase order. Each vehicle requires:

- Individual barcode or RFID scanning

- Separate tracking by vehicle ID or equipment number

- Asset-specific fuel allocations and limits

- Individual transaction records for maintenance tracking

- Consolidated billing with detailed line-item breakdown

SaaS Limitations: Standard SaaS platforms typically treat each fueling as a separate transaction, creating cumbersome workflows. Drivers must repeatedly log in and out, manually associate readings with assets, and manage complex reconciliation afterward.

Custom Software Advantage: Custom solutions excel in wet-hosing scenarios by streamlining the barcode-to-asset workflow. The system can:

- Rapidly scan multiple asset barcodes in sequence

- Automatically associate meter readings with the correct vehicles

- Track fuel allocation limits per asset

- Provide vehicle-specific fuel tracking for precise monitoring

- Generate comprehensive reports showing fuel consumption by vehicle

- Consolidate everything into a single master invoice

For enterprises specializing in fleet fueling, this operational efficiency represents a major competitive advantage and ROI driver that justifies custom development investment.

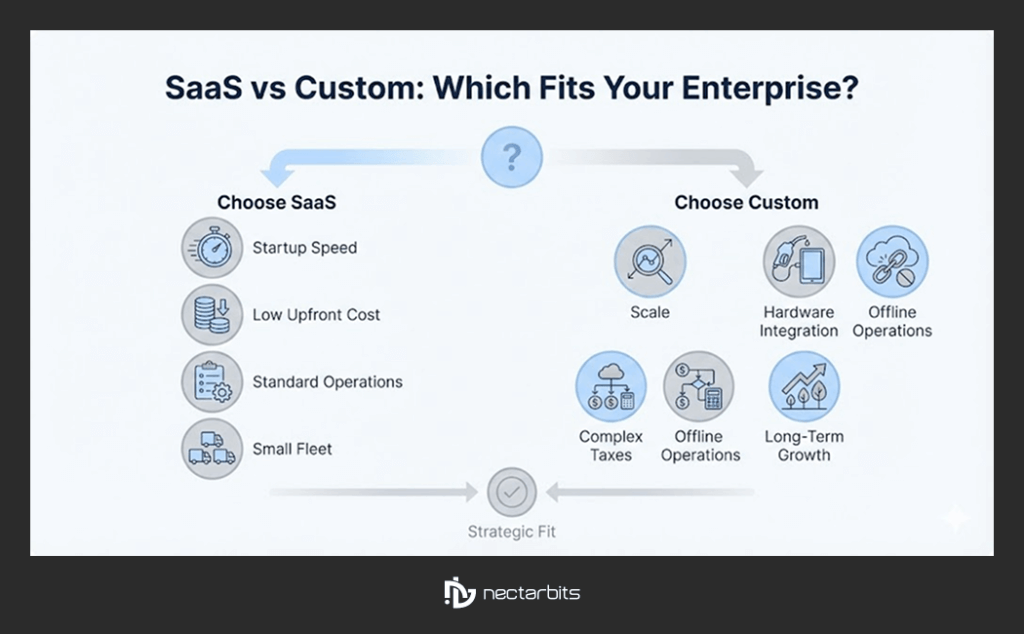

Strategic Decision Framework: Which is Right for Your Enterprise?

Making the fuel delivery software comparison requires evaluating multiple dimensions of your business context, growth trajectory, and competitive positioning.

When SaaS Makes Strategic Sense

Startup or Pilot Phase: If you’re testing the fuel delivery market or launching a new service line, SaaS minimizes upfront investment and allows rapid market validation. You can be operational within weeks rather than months.

Limited Technical Resources: Organizations without dedicated IT teams or technical leadership often find SaaS platforms easier to manage, as the vendor handles infrastructure, security updates, and technical troubleshooting.

Standardized Bulk Drop Operations: If your fuel delivery business follows industry-standard workflows focused primarily on bulk tank fills without unique processes, complex hardware requirements, or specialized operational models, SaaS platforms offer sufficient functionality at predictable costs.

Short to Medium-Term Horizon: For businesses with uncertain long-term commitment to fuel delivery or those planning eventual acquisition, SaaS avoids the complexity of custom software ownership transfer.

Modern Fleet with Standard Equipment: If your trucks utilize contemporary tablets and standard fueling equipment without legacy meters or proprietary hardware requiring specialized integration.

When Custom Development is the Superior Choice

Differentiated Business Model: Enterprises with unique value propositions—such as specialized fleet fueling services, proprietary scheduling algorithms, or innovative customer experiences—require custom solutions that can’t be replicated on standardized platforms.

Scale and Volume: Organizations processing 300+ daily deliveries find that custom development delivers better economics within 2-3 years while providing unlimited scalability without per-transaction fees.

Complex Hardware Integration: Operations utilizing Electronic Meter Registers (LCR, TCS systems), legacy equipment, or proprietary pumping systems require the deep hardware integration that only custom development provides. This is especially critical for preventing fuel theft and shrinkage.

Connectivity-Challenged Operations: If your drivers regularly operate in remote areas, underground facilities, or locations with unreliable cellular coverage, the offline-first architecture of custom solutions becomes essential rather than optional.

Fleet Fueling and Wet-Hosing Specialization: Businesses focusing on multi-vehicle fleet fueling require the sophisticated barcode-to-asset workflows that custom software delivers efficiently.

Multi-Jurisdictional Tax Complexity: Operations crossing multiple states or provinces with varying tax structures benefit enormously from custom-built tax engines that automate calculation and reporting.

Data Ownership and Privacy: Enterprises handling sensitive commercial accounts, government contracts, or requiring complete data sovereignty (especially in Canada with strict privacy laws) need custom solutions for full control.

Long-Term Strategic Asset: Organizations viewing technology as a core competitive advantage rather than a utility prefer custom development to build proprietary IP and create barriers to entry.

Read More: See How FuelBuddy-Like Apps Deliver Results →

| Decision Factor | Favor SaaS When… | Favor Custom When… |

| Daily Delivery Volume | Under 200 | 300+ |

| Operational Model | Primarily bulk drop | Fleet fueling/wet-hosing focus |

| Fleet Hardware | Standard modern tablets | Legacy meters (LCR) or proprietary systems |

| Coverage Area | Urban with reliable connectivity | Remote/rural with dead zones |

| Time to Market | Need launch in 4-8 weeks | Can plan 6-9 month timeline |

| Budget Year 1 | Under $100,000 available | $150,000+ allocated |

| Technical Team | No in-house IT capability | Have or can hire technical resources |

| Business Model | Standard industry approach | Differentiated/innovative |

| Geographic Scope | Single region, simple taxes | Multi-state/province, complex taxes |

| Integration Needs | Standard APIs sufficient | Hardware integration critical |

| Competitive Strategy | Fast follower | Market leader/innovator |

On-Demand Fuel Delivery App Development: Mobile Excellence

Mobile App Development represents a critical component of modern fuel delivery operations. Whether SaaS or custom, your mobile application must deliver exceptional experiences for both customers and drivers while handling the unique technical requirements of fuel delivery.

Customer-Facing App Features

Real-Time Order Tracking: Customers expect live updates on driver location, estimated arrival time, and delivery status. Both SaaS and custom solutions provide this capability, but custom apps can incorporate branded experiences and unique engagement features.

Flexible Scheduling: On-demand fuel delivery app development must balance immediate requests with scheduled deliveries. Advanced custom solutions can optimize scheduling to maximize efficiency while meeting customer preferences.

Multiple Payment Options: Modern consumers expect diverse payment methods including credit cards, digital wallets (Apple Pay, Google Pay), ACH transfers for commercial accounts, and invoice terms for established business relationships.

Loyalty and Rewards: Custom mobile apps can implement sophisticated loyalty programs tied directly to your business model, while SaaS platforms typically offer generic point systems.

Driver App Requirements

Offline Capability: The driver app must function fully without connectivity, storing all necessary data locally and syncing automatically when signal returns. This is non-negotiable for enterprise operations.

Hardware Communication: For custom solutions with Electronic Register integration, the driver app must communicate directly with the meter via serial connection or Bluetooth to capture exact gallons dispensed.

Optimized Route Guidance: Driver apps must provide efficient routing with real-time traffic updates and intelligent multi-stop optimization. Custom solutions can incorporate business-specific routing rules that SaaS platforms don’t support.

Digital Proof of Delivery: Photo capture, electronic signatures, and automatic documentation generation streamline operations and reduce disputes. These features are standard in both approaches.

Fleet Fueling Workflows: For wet-hosing operations, the driver app needs streamlined barcode scanning capabilities to rapidly process multiple vehicles under a single delivery order.

In-App Communication: Seamless communication channels between drivers, dispatch, and customers reduce delays and improve service quality. Custom apps can integrate with existing communication infrastructure.

Geographic Considerations: USA and Canada Market Dynamics

Enterprise buyers operating in North America face specific considerations that influence the SaaS versus custom decision.

United States Market

The USA fuel delivery market is highly competitive with established players and hundreds of regional distributors. Differentiation requires either superior pricing, better service levels, or innovative features that competitors can’t easily replicate.

State-by-State Regulatory Variance: Each state maintains different hazmat transport regulations, environmental reporting requirements, and tax collection rules. Custom software can embed state-specific compliance checks and automated IFTA reporting, while SaaS platforms typically offer only general frameworks requiring manual oversight.

Commercial Market Opportunity: The B2B fuel delivery segment, serving construction sites, agricultural operations, and commercial fleets, represents the highest-margin opportunity. These customers demand sophisticated features like multi-site management, detailed reporting, and integration with their procurement systems—capabilities better served by custom development.

Canadian Market Characteristics

Canada’s fuel delivery market presents unique opportunities and challenges for enterprise buyers.

Provincial Regulatory Complexity: Each province has distinct regulations for hazardous materials transport (TDG requirements), environmental compliance, and consumer protection. Quebec, in particular, requires French language support per Bill 96, which may require custom development regardless of starting with SaaS.

Data Sovereignty Under PIPEDA: The Personal Information Protection and Electronic Documents Act and provincial privacy laws impose strict data residency and handling requirements. Custom solutions provide clearer control over where data is stored and processed, critical for enterprises handling sensitive commercial relationships.

Extreme Weather Operational Challenges: Canadian fuel delivery operations contend with severe weather conditions affecting routing, delivery windows, and vehicle maintenance. Custom software can incorporate sophisticated weather-based routing algorithms and Canadian-specific traffic data sources optimized for winter conditions.

| Geographic Factor | USA Considerations | Canada Considerations |

| Market Maturity | High competition, need differentiation | Emerging opportunities, less saturated |

| Regulatory | State-by-state variance, IFTA | Provincial TDG, language requirements |

| Data Privacy | State laws (CA, NY, etc.) | Federal PIPEDA, provincial requirements |

| Weather Impact | Regional variance | Nationwide extreme conditions |

| Tax Complexity | Multi-layer state/local/federal | Provincial + GST/HST variations |

Conclusion: Making the Right Strategic Choice

Choosing between SaaS, custom, or hybrid fuel delivery software depends on how you operate today and how you plan to scale. SaaS fits businesses seeking fast deployment, lower upfront costs, and standardized bulk delivery at a smaller scale. Custom development is ideal for high-volume, enterprise-level operations that require hardware integration, offline reliability, complex tax handling, and a long-term competitive advantage. Hybrid (headless SaaS) offers a balanced path for companies wanting brand differentiation without full backend ownership. With the fuel delivery management market projected to reach $18.7B by 2030, the right software and hardware strategy will directly impact efficiency, theft prevention, scalability, and long-term market leadership.

Related Reading

How Custom Software Development Drives Enterprise Innovation – Discover how leading enterprises leverage custom software to build competitive advantages and drive digital transformation across industries.

FAQs:-

Most SaaS platforms show efficiency gains in 3–6 months, while custom solutions typically achieve stronger, long-term ROI within 8–12 months due to ownership, automation, and theft prevention.

By integrating directly with truck meters, the system automatically records exact gallons dispensed, eliminating manual entry, discrepancies, and unauthorized fuel loss.

SaaS users risk data lock-in and high extraction fees, whereas custom solutions ensure full data ownership and control without dependency on third parties.

Custom platforms support offline-first operations, allowing deliveries, invoicing, and data capture in remote areas with automatic sync once connectivity returns.