Quick summary: Making transportation affordable, eco-friendly, and efficient is why the carpooling app concept is brought to the world. The most complex part is handling payment and commission structure, which ensures the carpooling app’s success. These financial components ensure user trust and long-term profitability. The guide will help you explore managing the best payment and commission that bring the desired results.

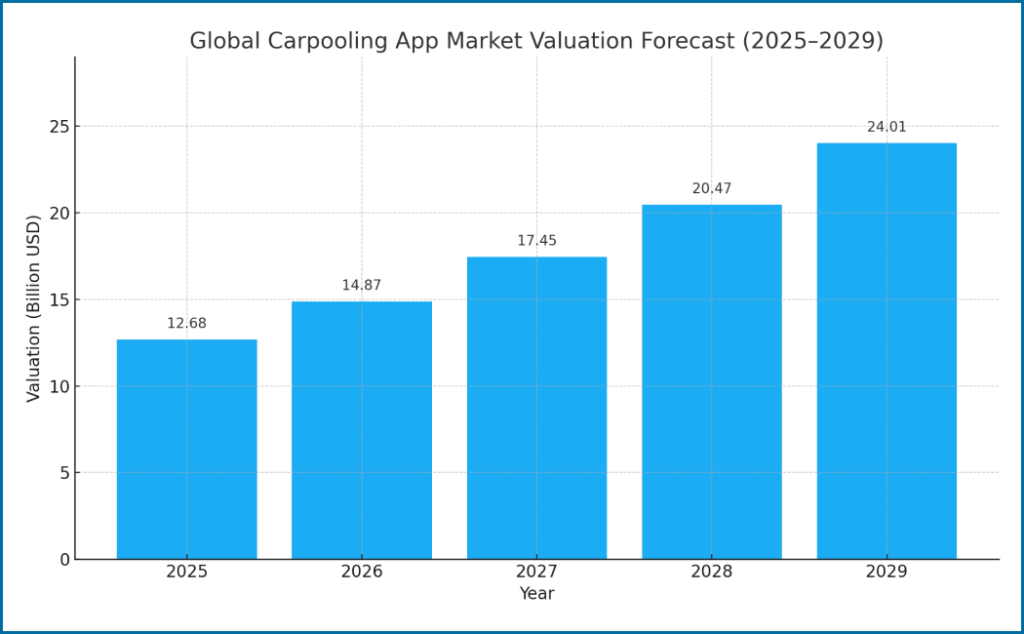

The carpooling app market reached $12.68 billion in 2025 and is expected to grow to $23.98 billion by 2029 at a CAGR of 17.3%. The rise of environmental awareness, ride-sharing initiatives, urbanization trends, and easier payment attributes to the growth of carpooling apps in the years to come. Asia-Pacific dominates 29.48% of the carpooling market share, driven by high urbanization and traffic congestion.

Without flawless payment handling, carpooling apps cannot earn user trust, drive sustainable revenue, reduce frauds and disputes, ensure regulatory compliance, and provide impartial earnings to providers. A well-designed commission structure is critical to helping strike a balance between carpooling service providers’ satisfaction and profitability.

This blog will explore the popular payment models used with carpooling payment system integration, commission structure setup, key challenges and solutions, and the best practices ensuring smooth transactions while using the carpooling app. Let’s explore!

Payment models for carpooling apps ensure the best payment handling

The well-structured payment handling system is the secret sauce behind every carpooling app’s success. Here are the payment models used mainly by carpooling apps to ensure convenience and transparency in payment.

Fixed fare model

This model is famously known as the pay-per-ride model, wherein the passenger pays the driver for every trip based on the distance covered and time consumed. The payment system auto-calculates the ride fare and displays the same to the passenger ahead of booking, and after the ride, the driver is paid the same amount. Fare prediction for both passengers and drivers simplifies the booking process.

Dynamic pricing model

The dynamic pricing model is one of the best payment methods for carpool apps that auto-adjust the trip fare based on traffic congestion, peak hours, high demand, and fuel prices so that passengers get the ride at competitive rates. The algorithms dynamically provide rates based on a couple of factors, which help balance the supply and demand ratio. UberPool uses dynamic pricing for shared rides to incentivize drivers during peak hours, and passengers get rides in high-demand zones.

Subscription model

Scoop-like carpooling apps enabled a subscription pricing model wherein passengers subscribe for unlimited or discounted rides after paying the fees weekly or monthly. The passengers choose the subscription model based on the frequency of rides needed, and drivers are paid only for the trips completed. It’s a cost-effective alternative for daily commuters and encourages the regular use of the carpooling app.

Cost-sharing model

This pricing model is ideally used by the community, wherein the fuel and toll costs are equally split after the carpooling ride. Such a model encourages community spirit, keeps fares low, and prevents drivers from charging extra money. However, no formal payment structure allows passengers to get an idea about payment.

Corporate model

Leading organizations sponsor carpooling apps for their employees, giving them access to sponsored rides that are eco-friendly and cost-effective. Limited organizations employ the corporate model, but it helps reduce companies’ traffic and parking issues.

How does a carpooling app make money with fair commission structures?

With payment handling, passengers can pay for the rides reasonably, but carpooling app owners need commission structures to make money. Companies use some commission structures that are the backbone of the carpooling app’s monetization strategies. Here are the commission structures that realize long-term success.

Flat percentage commission

This widely used commission model involves deducting a fixed percentage from every transaction after completing the ride. The simple and transparent commission structure scales with app usage, but it’s expensive when drivers’ margins are low.

Tiered commission structure

The commission structure for the carpool app auto-adjusts the commission based on the number of rides completed, distance covered in a day, and driver performance. The high-performing and highly-rated drivers are charged low commission rates, but high commission charges are deducted for short trips. The commission structure boosts driver engagement and increases retention.

Subscription for drivers

For handling commissions in mobility apps, the subscription model involves drivers paying a monthly fee to use the platform to get ride requests. Instead of per-ride commission, the subscription fees ensure a steady income for the drivers but deter part-time drivers.

Hybrid model

The hybrid model combines a subscription and lower commission model wherein drivers subscribe to the platform and avail of the lower commissions for every ride. It helps frequent drivers increase their earnings and create a steady revenue stream for the company.

Challenges and solutions to ensure a smooth ride

Behind the scenes, carpooling app operators face complex financial issues related to payment handling and commission structure. Let’s unpack all of the challenges and their solutions.

Payment security and fraud prevention

Carpooling app involves online payment through credit cards, debit cards, mobile wallets, and others, which can be stolen by fraud or manipulated by Trojan horses. It can be avoided with trusted payment gateways, tokenization & encryption, two-factor authentication, and AI-driven fraud detection.

Delayed or failed payment

Sometimes, the payments are delayed or failed due to network issues, which dissatisfies passengers and drives revenue loss to the company. Here, pre-authorization of funds, an automated retry mechanism, and fallback payment options will help prevent delayed or failed payments.

Legal and compliance issues

Payment and commission structure must comply with transportation industry regulations that vary based on region. If anything goes wrong, the app is subjected to heavy penalties. Ensuring the ride-sharing commission model setup and carpooling payment system integration adhere to local tax laws and follow KYC/AML procedures will help.

Cross-border payments

When the carpooling app operates worldwide, currency conversion, managing exchange rates, and enabling cross-border transactions seamlessly is difficult. Using multi-currency wallets that allow users to hold money in the local currency and integrating local payment partners will help. With dynamic exchange rate API integration, the accurate fare and payout to drivers are calculated in real time.

Refunds and chargebacks

Refunds or chargeback handling is tricky when rides are unexpectedly canceled or turn out dissatisfactory. Here, the refund policies for drivers and passengers are published to resolve their refund queries. In-app dispute resolutions through chatbots or customer support allow passengers to report and resolve their issues.

The best practices that guarantee seamless transactions

The cost of developing an MVP carpool app is relatively lower compared to full-fledged carpool app development, and it helps businesses identify if the app idea works in the niche market. Similarly, following the best practices improves the payment flow and enhances user satisfaction.

- Integrate trusted, PCI-DSS-compliant payment gateways like- Stripe, PayPal, Razorpay, or Braintree for secure transactions.

- To increase user convenience, offer multiple payment options such as mobile wallets, cards, UPI, and others.

- Implement a fair and transparent fare structure before the ride, including basic fare, platform fee, distance cost, and driver earnings.

- Driver Payout Solutions in India automatically credits the payout to the driver’s account after the passengers clear the invoice.

- Enable two-factor authentication to secure transactions and prevent unauthorized access.

Conclusion

Let’s accept it: If you opt for White-label Carpool Website Software or SaaS small business solution to shape a carpooling app idea into reality, it works out only when payment handling and commission structure are optimized. It builds trust, brings fairness, and adds reliability that ensures your app retains drivers and passengers and scales without technical glitches. Connect with a carpooling or car rental app development company that helps build a platform that blends innovative technology with a transparent payment system, helping passengers enjoy their journey instead of focusing on transactions.

FAQs

Passengers pay the fare before or after the ride through the platforms, and the payment is then processed through secured payment gateways such as Stripe, PayPal, etc.

The carpooling platform employs a tiered-based or dynamic commission model, and the commission rate varies according to the driver’s performance, trip distance, and time of the day.

The payout is released daily, weekly, or monthly- the driver selects the custom schedule. Some platforms enable instant payout as soon as the transaction is completed.

When the payment fails during the transaction, the app displays a message to retry the payment process or ask the user to update the payment process.

When the rider cancels the ride within a defined time, the refund is provided in whole or partially to the original payment method.