You’ve got a last-minute dinner plan, but you’re out of a key ingredient. A decade ago, this meant a frantic dash to the nearest store. Today, you can tap a few buttons on your phone, and a grocery delivery rider is at your doorstep with that missing item in fifteen minutes. This isn’t just a new service; it’s a quiet revolution in how we shop for everyday essentials.

The Rise of Hyperlocal Quick Commerce

Remember when you had to plan your grocery run? Over the last few years, we’ve seen a massive shift in how people get their groceries. It started with online ordering for next-day delivery, but now, a new breed of services promises to get you a carton of milk or a bag of chips in a flash. This isn’t just about convenience; it’s a new frontier in retail, fundamentally reshaping consumer expectations.

What is Hyperlocal Quick Commerce?

At its core, hyperlocal quick commerce delivers goods to a customer within 10 to 30 minutes. The “hyperlocal” part is key. Instead of a massive central warehouse, these services use a network of small, strategically placed fulfillment centers, often called “dark stores”. This proximity to the customer is what makes the “quick” part possible.

The Market Opportunity: Why Enterprises Need to Pay Attention

The demand for instant gratification is on the rise. We’ve all gotten used to streaming movies, hailing rides, and having dinner delivered in minutes. This desire for speed has naturally spilled over into retail, especially for things we need right now, like groceries. For large enterprises, this is a seismic shift they must address to stay competitive.

The Shift from Traditional E-commerce to Instant Gratification

Traditional e-commerce was built on a model of efficiency over speed. It works great for a new pair of shoes, but for that forgotten dinner ingredient, waiting a day or two just doesn’t cut it. Quick commerce is an evolution of this. It takes the online ordering experience and compresses the delivery timeline, targeting immediate needs rather than planned purchases.

Key Business Models and Core Components

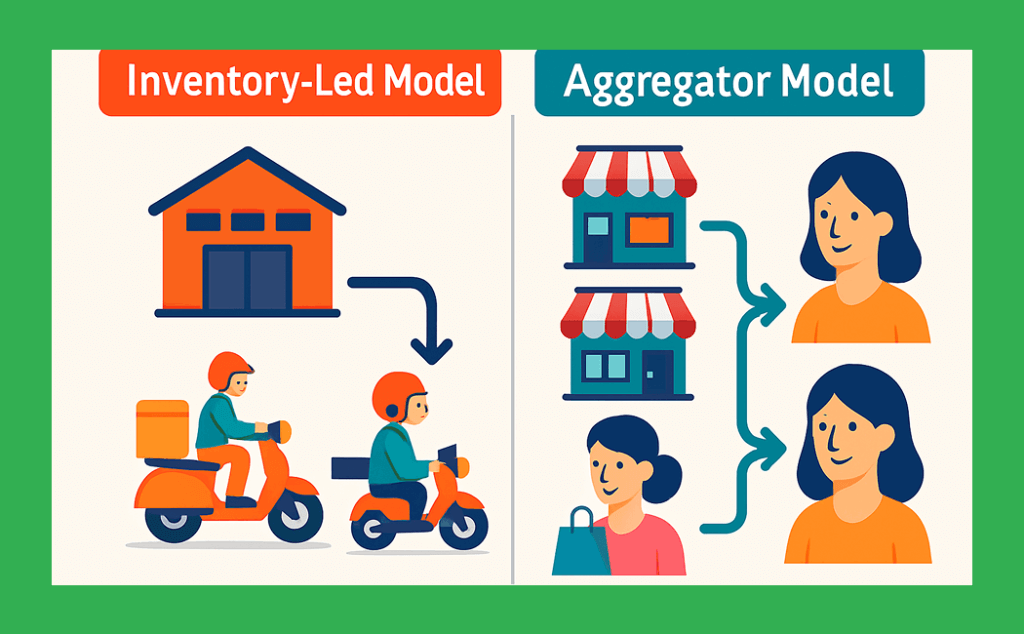

The Inventory-Led Model: Leveraging Dark Stores and Micro-Warehouses

This model is all about control. Companies like Zepto’s business model operate their own dark stores. They own the inventory, manage the stock, and pack the orders themselves. This gives them a high degree of control over the customer experience. It’s a capital-intensive approach, but it allows for tight control over the entire supply chain, which is critical for that guaranteed fast delivery.

The Aggregator and Marketplace Models

The aggregator model is more like a digital version of a shopping mall. Instead of owning the inventory, the Instacart business model partners with existing grocery stores. The customer places an order on the app, and a “shopper” goes to a nearby store, picks the items, and delivers them. This model is less capital-intensive and allows for a wider product selection since it draws from multiple stores.

The Gig Economy: Powering the Last-Mile Delivery Network

No matter the business model, the last-mile delivery network is the beating heart of quick commerce. These companies rely heavily on the gig economy, a flexible network of independent delivery riders. These are the people who make the magic happen, zipping through city streets to get orders to customers in a hurry. Managing this fleet efficiently is an absolute must for success.

The Technology Stack for Enterprise-Grade Solutions

Building a Robust App: Frontend and Backend Considerations

The customer-facing app needs to be fast and intuitive. People are in a hurry, so they want to find what they’re looking for, place their order, and check out with minimum fuss. On the back end, the system must be a powerhouse, connecting the customer order to the nearest dark stores, updating inventory in real-time, and assigning a delivery partner all within seconds. The app is the foundation for a successful online grocery shopping platform.

The Role of Data Analytics and AI in Demand Forecasting

To avoid food waste and keep those dark stores properly stocked, these businesses rely on data analytics and AI. They analyze things like past purchase history, local weather, holidays, and even traffic patterns to predict what people will order and when. This allows them to make smarter decisions about inventory.

Real-Time Tracking and Inventory Management Systems

Transparency is a big deal for customers. They expect to know where their order is at all times. A robust system provides a live map, from the moment a picker grabs the first item to the moment the grocery delivery partner is at their doorstep. For companies considering grocery delivery app development, this is a non-negotiable feature. Similarly, the inventory management system must be in lockstep with every order, updating stock levels instantly.

Operational Excellence and Supply Chain Management

Optimizing Logistics: Route Optimization and Fleet Management

This is where the rubber meets the road. A delivery partner can’t just follow Google Maps; the system must provide optimized routes that account for traffic, one-way streets, and other real-time factors to ensure the fastest possible trip. Fleet management software needs to show where all the delivery partners are at any given moment.

Overcoming Challenges: Managing Volatile Demand and Delivery Costs

Quick commerce is a tough business with notoriously thin margins. Demand can spike unpredictably during a sudden thunderstorm or a major sports event. These companies have to figure out how to scale up their operations instantly to meet this demand without the costs getting out of control. It’s a balancing act.

Maintaining Quality Control and Customer Experience

What happens when a customer receives a bruised avocado or a leaking carton of milk? The speed of delivery is useless if the product is bad. Companies have to build rigorous quality control into their dark store operations. This also extends to the customer support side, as issues will inevitably arise. The ability to respond quickly and effectively to problems is a major factor in retaining customers and building a reputable hyperlocal grocery delivery platform.

Strategic Advantages for Enterprises

Boosting Customer Loyalty and Lifetime Value

The speed and convenience of a good hyperlocal quick commerce experience create a strong bond with customers. Once they rely on a service for those last-minute needs, they’re likely to keep coming back. This frequent, low-friction interaction can significantly increase their lifetime value.

Creating a Competitive Moat in a Crowded Market

In a world where everyone sells the same products, a great experience is the only true competitive advantage. Building the best grocery delivery app creates a “moat” that’s difficult for competitors to cross. It’s not about having the best prices anymore; it’s about being the most reliable and convenient option.

Scalability and Expansion into New Urban Areas

Because the model is built on small, localized hubs, it’s highly scalable. Once you’ve perfected the blueprint for a dark store, you can replicate it in new neighborhoods, cities, and even countries with relative ease. This allows for rapid expansion and a fast-growing footprint in the urban landscape.

Conclusion

Hyperlocal quick commerce is more than a fleeting fad; it’s the logical next step in the evolution of retail. It’s a challenging business, a true test of operational and technological prowess. Yet, for enterprises willing to invest in the right infrastructure, a thoughtful approach, and a deep understanding of their customers’ needs, the rewards are immense. This isn’t just about making grocery delivery faster. It’s about building a business that’s woven into the very fabric of urban life, solving a real problem for people, and in the process, becoming indispensable.

Frequently Asked Questions (FAQs)

The key difference is the delivery timeline. Traditional e-commerce focuses on efficiency for non-urgent deliveries (e.g., 2-3 days), while hyperlocal quick commerce targets immediate needs, promising delivery within 10 to 30 minutes.

A dark store is a small, local fulfillment center that is not open to the public. It is a mini-warehouse stocked with a curated selection of products specifically designed for quick order picking and fast grocery delivery to local customers.

They use advanced technology, including data analytics and AI, to forecast demand based on historical data, weather, and local events. They also rely on a flexible gig economy workforce that can be scaled up or down instantly to meet sudden spikes in demand.

The two primary models are the inventory-led model, where the company owns its own inventory and dark stores (e.g., Zepto), and the aggregator/marketplace model, where the company partners with existing grocery stores and uses gig workers to pick and deliver items (e.g., Instacart).

Data analytics is crucial for several reasons: it enables accurate demand forecasting to prevent food waste and stockouts, optimizes picking routes within dark stores, and facilitates real-time tracking and efficient fleet management to ensure fast deliveries.