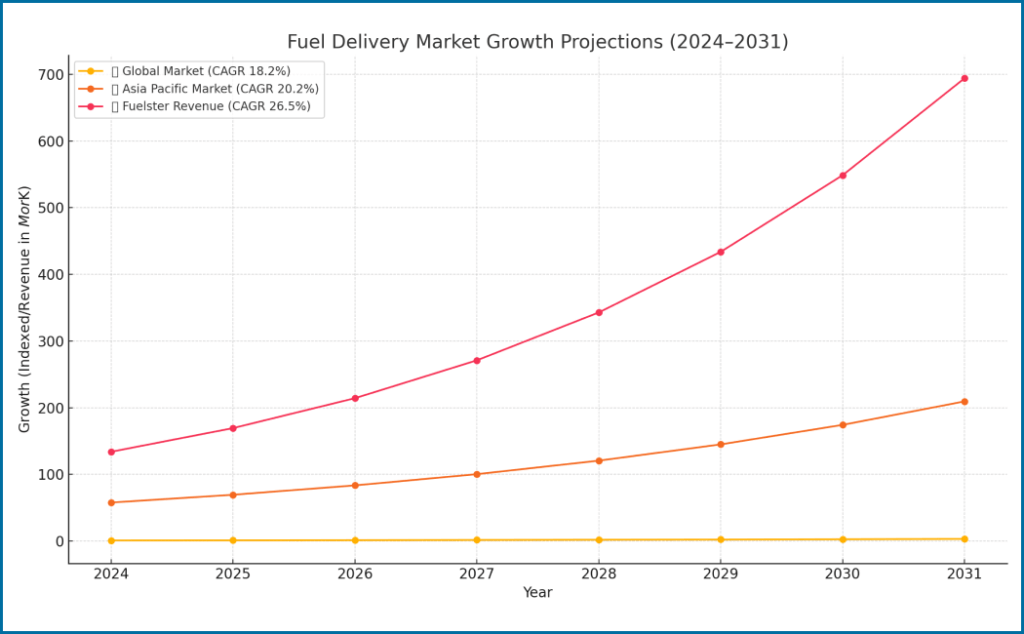

The convenience of the fuel pump-free future is becoming a new norm with on-demand fuel delivery applications that will expand at a compound annual growth rate of 18.20% from 2024 to 2031. Asia Pacific held the market of around 23% of the global revenue with a market size of $57.78 million in 2024 and will grow at a CAGR of 20.2%.

There are multiple fuel delivery apps, such as Boston, Yoshi, Fuelbuddy, and Fuelster, that are consistently growing with strategic partnerships. Out of all fuel delivery apps, Fuelster is growing boundlessly with modest revenue figures as compared to fuel delivery tech giants.

Fuelster- the London-based fuel delivery start-up that’s making a real-world impact with mobile refuelling is marking a 26.5% year-over-year growth since 2016. The Fuelster business started with a lean team of four employees and has raised $397,000 in funding. Later, collaboration with MGM Resorts drives the launch of an on-demand mobile fuel delivery service at Las Vegas properties.The continuous revenue growth of Fuelster Technologies is the result of its increasing adoption by businesses, growing user base, and unique business model.

The impressive revenue of the Fuelster app is the result of the unique Fuelster business model that combines conventional logistics with digital convenience. Fuelster taps into the user market that’s taking convenience-first and modernized businesses. This blog will take you a deep dive into the business model of Fuelster that helps bring large revenue.

Fuelster business model breakdown that you need

Similar to the on-demand fuel delivery business, Fuelster operates on logistics and an on-demand platform model uniquely. Here’s how Fuelster operates.

Target customers

The USP of the Fuelster app is on-demand fuel delivery that’s prioritized by a wide range of customers. Individual vehicle owners such as urban professionals, students, or tech-savvy millennials who need doorstep fuel delivery via the app and want to avoid contact with pumps and handles opt for Fuelster.

Corporate fleets for delivery services, rental companies, or corporate campuses need predictable cost and refuel scheduling to eliminate the need for fleet drivers to stop for fuel and look for fuelster services. Event planners for large events, festivals, or sports that require onsite fuel services during emergencies or overnight prefer Fuelster as it meets the refuelling need without setting in-house fueling infrastructure.

Value proposition

Fuelster’s value proposition provides a tech-driven answer to the age-old problem of going to the fuel station to refuel the tanks. It eliminates friction, adds convenience, and saves time with doorstep fuel delivery. It saves time for individuals, parents, and corporate drivers with the ability to bring fuel wherever the vehicle is parked.

With app-based scheduling, fuel selection, and payment, and notification in real-time for refuelling, the digital experience is a boon for customers interested in contactless interactions, Gen Z users, or fleet managers. Digital fuel tracking and billing make it easier for tax-sensitive customers and government buyers to automate expense logs, generate invoices, and make the accounting records ready for audit.

Cost structure

The Fuelster company spent a huge amount on launching a digital doorstep fuel delivery business. The capital-intensive operations and tech-driven variable costs include fleet operation and maintenance costs, fuel procurement costs, custom fuel delivery app development, general administrative costs, marketing costs, and insurance and compliance fees.

Fleet acquisition or leasing for fuel delivery and maintenance is the biggest and fixed cost that businesses need to bear. Additionally, buying fuel in bulk or partnering with fuel distributors at negotiated prices is accompanied by storage and transportation costs. Building custom fuel delivery apps, websites, GPS tracking, scheduling, and payment systems requires an expensive initial investment. The associated insurance and compliance costs are mandatory in the highly regulated industry.

Key partners

To operate efficiently, fuelster businesses need to collaborate with different partners such as fuel suppliers, compliance and safety regulators, logistics tech providers, and corporate clients. The Fuelster company partners with fuel suppliers, such as fuel depots or wholesalers, to purchase the fuel in bulk and store it safely.

They partner with compliance and safety regulators such as local and federal agencies (DOT, fire marshal, and EPA) that ensure services are legally compliant and audit-ready. Collaborating with logistics tech providers helps enable GPS tracking, route optimization, and payment processing functionalities.

Revenue stream

Fuelster, which is a B2B platform, is capital-intensive, and the company manages the funds. However, without a revenue strategy in place, running the doorstep fuel delivery business is implausible. The following revenue models create recurring income for fuelster-like businesses.

Service Fee

Fuelster charges a convenience fee per delivery that ranges from $3.99 to $7.99 per delivery. The users who need urgent deliveries need to pay higher charges, which keeps the business profitable in service areas. Waiving the delivery fee during promotions also increases the costs by a great margin.

Fuel Margin

Fuelster purchases fuel in bulk at wholesale prices and then sell it to the users at the place they want at retail prices. For example, the wholesale price of fuel is $3.70/gal, and Fuelster charges between $3.90–$4.10/gal, which is close to fuel station prices. The margin brings good revenue on every transaction and increases when the volume of fuel delivery increases.

Subscription Plans

Businesses and frequent users opt for monthly or annual subscription plans to avail of the priority services or discounted fees such as free delivery, lower fuel prices, loyalty rewards, and priority scheduling. It brings predictable revenue and offsets customer acquisition costs.

Fleet Contracts

Fuelster sign long-term deals with fleet and commercial companies to refuel fleets regularly at custom prices based on the volume of fuel needed. The recurring delivery schedules, that’s weekly or monthly, involve monthly or quarterly invoice generation that brings income in advance. Also, the premium support and faster refuelling options act as an upsell, which increases earnings. This way, ROI is increased, customer churn rates get reduced, and customer lifetime value is amplified.

White-label

Fuelster partnered with MGM Resorts in Las Vegas to offer co-branded fuel delivery services, wherein MGM Resorts takes care of Fuelster promotions. The potential integration with other vehicles or logistics platforms involves revenue sharing that may include upfront setup fees or ongoing management fees, but reduced marketing cost and increased user outreach pays it off.

Revenue Models

| Revenue Stream | Frequency |

| Fuel margin fee | High volume |

| Delivery Fees | Per delivery |

| Fleet Contracts | Monthly/weekly |

| Subscriptions | Monthly |

| Partnerships | Custom |

Conclusion

Fuelster’s performance gains and financial gains are the result of its well-defined business model. With every aspect of Fuelster’s business being well-defined, from target customers, value proposition, cost structure, key partners, and revenue streams, success is at the doorstep of business owners. Suppose you are planning to build a Fuelster-like custom fuel delivery app development. In that case, partner with a reliable fuel delivery app development company that helps with user research, identifying market gaps, building a fuel delivery app and website, and creating a revenue strategy. Don’t wait for your competition to take a plunge. Collaborate with the mobile app developers and get started

FAQs

Fuelster’s business model brings revenue through delivery fees, fuel markup price, fleet contracts, subscriptions, and white-label. Data monetization and strategic partnership models are used once the app gains enough popularity.

Fuelster’s business model targets customers who are individual users looking for convenient doorstep delivery, corporate campuses, businesses with large fleets, and event organisers.

Yes, the fuelster business model is scalable and seamlessly accommodates growing needs with increased partnerships with fuel suppliers, adapting to changing regulations, logistics optimization, and improved fleet utilization.

Yes, the fuelster business model has evolved to accommodate EV-charging vehicles with mobile EV charging capability.

Fuelster’s business model is profitable and increases the bottom line if adopted, but businesses need to address the challenges, such as high upfront investment, regulatory and safety compliance, customer acquisition in areas where fuel is easily available, and ensuring profitability with delivery density.