quick Summary

- The grocery delivery market is expected to $1.49 trillion by 2030, demanding sophisticated inventory solutions

- AI-powered systems are reducing food waste by 20-38% while improving forecast accuracy to 99.96%

- Enterprise implementations showing 15x processing efficiency gains and 80% cost reductions

- Smart inventory platforms offering ROI within 6-24 months through automated replenishment and real-time tracking

- Integration challenges requiring phased deployment with EDI/API hybrid approaches for optimal supplier connectivity

Introduction

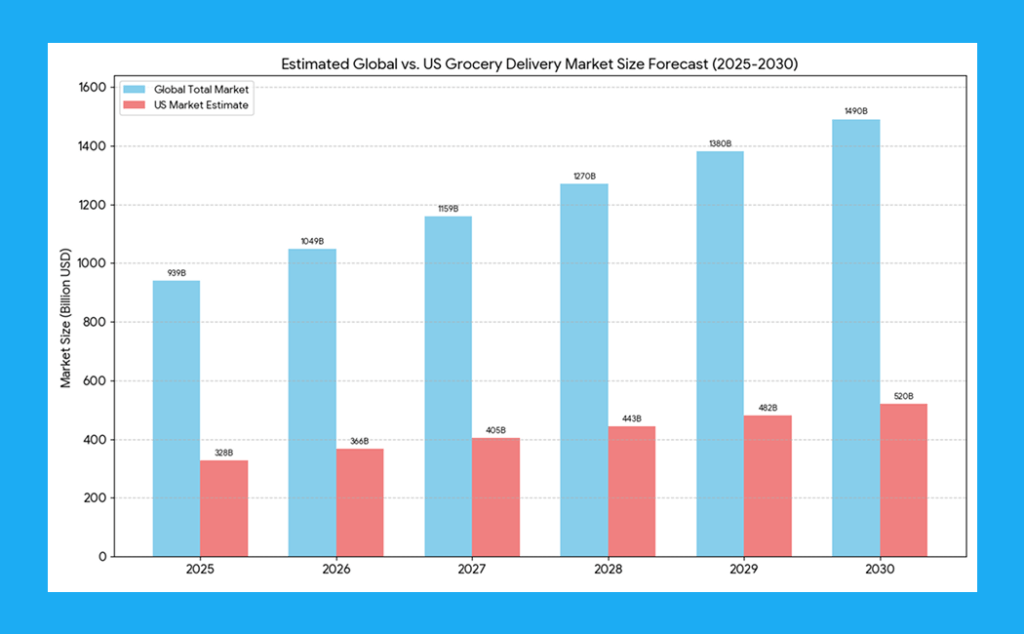

The grocery delivery market represents a staggering $938.98 billion opportunity in 2025, growing at a 9.74% compound annual growth rate to reach $1.49 trillion by 2030 (Statista, 2025). Yet beneath this explosive growth lies a sobering reality: 30-40% of the US food supply goes to waste annually, costing the industry approximately $161 billion(USDA – 2024). For grocery delivery startups, this presents both the ultimate challenge and opportunity – how do you capture exponential market growth while solving one of retail’s most persistent problems?

The answer lies in grocery inventory management software that transforms traditional reactive approaches into predictive, AI-driven systems. Modern solutions don’t just track stock levels; they orchestrate complex supply chains, predict demand with surgical precision, and eliminate the guesswork that leads to empty shelves or overflowing dumpsters. The companies mastering this balance aren’t just surviving the delivery revolution – they’re defining it.

The Grocery Delivery Inventory Challenge

Market Explosion Statistics:

- Global grocery delivery market: $938.98B (2025) → $1.49T (2030)

- US market leadership: $327.9B representing the world’s largest single market

- Consumer adoption: 67% of Americans now shop for groceries online

- Average online transaction: $112 vs. $42.83 in-store

The Waste Crisis:

- Annual food waste: 30-40% of US food supply ($161B value)

- Retail contribution: 16 billion pounds from US stores yearly

- Quick commerce pressure: 8.7% increase in quick trips, 11% fewer items per basket

Technology Impact:

- AI adoption results: 69% revenue increase, 72% cost reduction

- Processing efficiency gains: Up to 15x improvement in leading implementations

- Waste reduction potential: 20-38% through smart inventory systems

- ROI timeline: 6-24 months average payback period

Why traditional inventory methods fail in delivery-first operations

Traditional grocery inventory management was built for a different era. Store managers walked aisles with clipboards, reordered by gut, and treated spoilage as an inevitable cost. Inventory management for grocery delivery plays by different rules, and the old playbook simply doesn’t work.

Time Compression: The New Constraint

The fundamental challenge is time compression. Where traditional grocers had days or weeks to move products, delivery services must operate in hours. Fresh produce can arrive Monday morning and still be expected for same-day delivery that evening. The margin for error shrinks from days to minutes, and operational complexity multiplies.

Data Reality: Orchestration at Scale

Modern operators face unprecedented data velocity and volume. For example, Instacart processes roughly 200 million items every 60 minutes across 80,000+ retail locations, collecting millions of data points daily from hundreds of thousands of shoppers (Instacart 2025). This is not inventory management in the spreadsheet sense; it’s orchestrating a real-time symphony of supply, demand, and logistics at scale.

Perishability Multiplies Risk

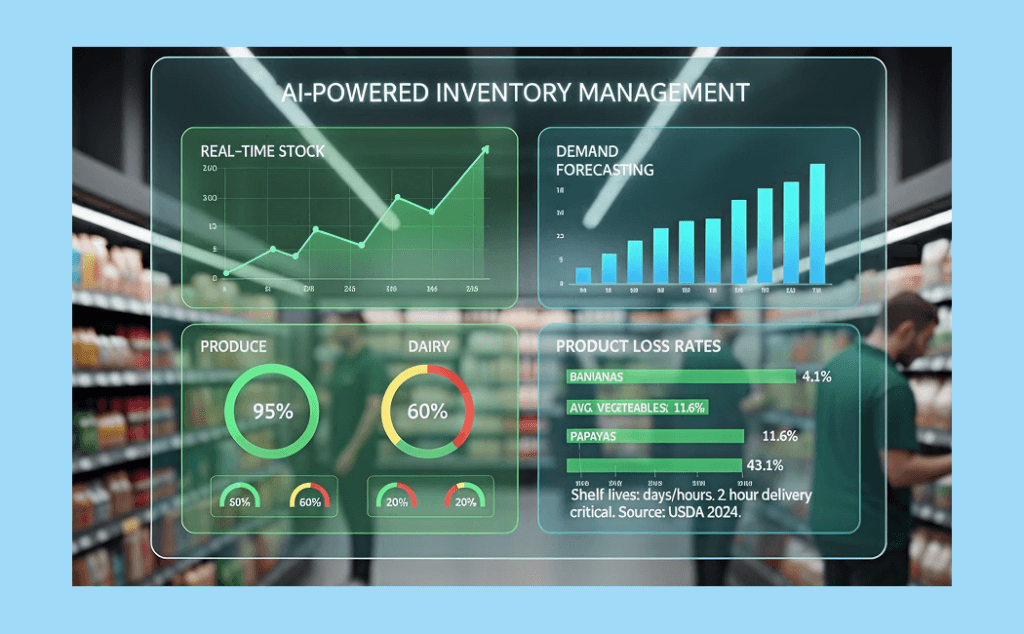

Perishability adds another layer of difficulty. Items that once sat on shelves for weeks now have shelf lives measured in days or hours. Loss rates vary by product. Fresh produce loss ranges widely (bananas ≈ 4.1% to papayas ≈ 43.1%), and average losses for some fresh vegetable categories can exceed 11.6% (Economic Research Service / USDA 2024). When two-hour delivery windows are on the line, those percentages are business critical.

Startups Face a Steeper Hill

Startups lack decades of supplier relationships and predictable customer baselines. They must build sophisticated forecasting models while learning local demand patterns in real time, essentially flying the plane while building it, and every misstep shows up immediately in customer satisfaction and the bottom line. Success requires a grocery delivery app development that integrates seamlessly with inventory systems from day one.

How AI Transforms Demand Forecasting for Fresh Inventory

AI inventory management for grocery operations is not a silver bullet, but it has remade what forecasting can do for perishables.

- Leading platforms claim dramatic accuracy gains: Puzl AI reports near-perfect demand prediction accuracy over multi-week horizons (Puzl AI 2024), while Afresh cites very high order suggestion adherence from its neural networks (Afresh 2024).

- Modern systems ingest hundreds of external signals: Guac, for example, folds in 230+ variables—weather, local events, and even unexpected signals—to reduce waste and sharpen forecasts (Guac 2025).

- Specialized vendors (e.g., LEAFIO AI) incorporate expiration dates, supplier slots, and weekday patterns into forecasts, reporting meaningful reductions in write-offs and excess stock (LEAFIO AI 2025).

Probabilistic Forecasting: The Practical Leap

Advanced grocery inventory management software solutions provide distributional forecast ranges and confidence intervals rather than single-point guesses. That matters: decisions about safety stock, promotions, and supplier commitments are safer when based on probabilities.

Continuous Learning and Autonomy

Some platforms combine predictive and generative models with automated model management so forecasts improve over time with less manual tuning (SymphonyAI 2025). For startups without large data-science teams, that’s a massive competitive advantage, especially when operating in hyperlocal quick commerce markets where precision matters most.

Real-Time Tracking Eliminates Inventory Blind Spots

Inventory visibility has moved beyond barcode scans. Modern stacks combine RFID, IoT sensors, and computer vision to close blind spots:

- RFID and wide-radius scanning can rapidly inventory sections without line-of-sight, increasing accuracy from typical 60% levels to the mid-90s (Datascan / Industry Research, 2024–2025).

- Cold-chain capable RFID tags are now low-cost and operate reliably in sub-zero environments, which is essential for frozen and refrigerated goods (Industry Research, 2024).

- Integrated tracking feeds forecasting engines: RELEX, for instance, ties real-time stock telemetry to machine learning forecasts that consider price, promotions, and local events, creating a virtuous feedback loop (RELEX 2025).

Instacart’s rework of inventory prediction demonstrates the payoff: a dramatic increase in processing throughput, far lower compute cost, and more accurate availability predictions (Instacart 2025). That kind of precision improves “found rates” at checkout and reduces disappointment and churn, critical factors that AI personalization grocery delivery systems leverage to enhance customer experience.

Automated Replenishment: Cut Manual Error and Labor Costs

Moving from manual reorder to automated replenishment is where operators see immediate ROI with grocery inventory management software.

- Robotic and software automation systems generate orders and handle physical moves while optimizing reorder points and timing (AutoStore 2025).

- Even software-only solutions cut manual inventory work dramatically; some POS-linked systems reduce monthly manual hours from ~30 to ~8 (FTx POS 2025).

- Intelligent automation adjusts to changing conditions: LEAFIO AI adapts reorder logic for shelf life and FIFO/FEFO rotation, not just historical averages (LEAFIO AI 2025).

Supplier integrations (EDI + APIs) further streamline the flow: major distributor networks process millions of transactions daily, slashing manual entry errors and accelerating PO cycles (Industry Research 2025). For startups, early supplier connectivity yields credibility and operational leverage.

Supplier Integration: The Backbone of Scale

Robust supplier integration goes beyond order placement. Leading practices mix EDI’s reliability with modern APIs’ real-time visibility:

- Platforms like TrueCommerce and large distributors provide pre-connected networks that ease onboarding and transaction management (TrueCommerce 2025).

- Retailer supplier APIs (example: Walmart’s developer ecosystem) enable real-time product and availability sync, expanding catalogs without the overhead of handling each supplier individually (Walmart Developer Portal 2025).

- More advanced collaborations implement vendor-managed inventory (VMI) models and shared forecasting. Amazon + P&G style partnerships have reduced operating costs and improved service levels (Supply Chain Case Studies 2024), demonstrating how the Instacart business model and similar platforms benefit from deep supplier relationships.

Integration is complex data mapping, and compliance takes effort, but the payoff is fewer stockouts, lower inventory costs, and far fewer manual errors (Industry Analysis 2025).

Perishables: FEFO, Cold Chain, and Traceability

Inventory management for grocery delivery demands specific controls for perishables:

- FEFO (First Expired, First Out) prioritizes based on expiry, which is critical when the arrival date and usable shelf life diverge. Modern systems automate FEFO with expiration tracking and alerts (Datascan 2025).

- IoT temperature monitoring ties into inventory systems so deviations trigger automatic quarantine, reprioritization, or markdowns rather than surprise losses.

- Regulatory traceability (e.g., FDA FSMA Section 204) raises the bar for recordkeeping, and quick recall response systems must capture Critical Tracking Events and enable fast lookups (FDA FSMA 2024).

- Smart packaging and MAP (modified atmosphere packaging) can extend shelf life for many items, but only when inventory systems track the extended dates and rotate stock properly (Food Preservation Research 2024).

Financials That Matter to Executives

The math is persuasive when operational gains convert to cash:

- Large players’ infrastructure gains show outsized efficiency (Instacart 2025).

- Retail pilots report meaningful waste reduction and direct savings, e.g., Price Chopper’s partnership prevented 20 tons of weekly waste across participating stores (Progressive Grocer 2024).

- Typical implementation costs vary widely; mid-tier deployments may start at tens of thousands with monthly licensing at a wide range depending on scale, but payback periods are often 6–24 months through labor savings, lower spoilage, and fewer stockouts (Implementation Cost Analysis / Industry Analysis 2025).

Working capital improvement (faster turns, less cash tied up in stock) and avoided customer churn from unavailable recommendations make the ROI case stronger than immediate cost-savings alone.

Practical Implementation Roadmap for Startups

A phased approach minimizes disruption and unlocks early wins with AI inventory management for grocery operations.

Phase 1 – Foundation (0–6 months)

- Implement FEFO and basic traceability

- Deploy IoT temperature monitoring and clean the data (barcodes, UOM)

- Pilot forecasting on high-volume perishables with an off-the-shelf specialist

Phase 2 – Integration & Automation (6–18 months)

- Roll out EDI/API supplier connections

- Automate replenishment and inter-location transfers

- Introduce smart packaging pilots and blockchain/immutable logs for traceability where needed

Phase 3 – Optimization & Scale (18+ months)

- Expand ML coverage to more SKUs and stores

- Implement circular solutions for unavoidable waste and show measurable sustainability outcomes

- Mature vendor partnerships and VMI models

Parallel testing, staff training, and conservative automation thresholds reduce risk during each phase. Many startups see material ROI before full rollout completes.

Conclusion

Delivery-first grocery turns inventory into the core battleground for competitive advantage. Traditional clipboards and gut reorders won’t scale to two-hour delivery promises, complex perishability, and real-time customer expectations. Smart forecasting, real-time tracking, automated replenishment, and deep supplier integration change the calculus, reducing waste, improving fill rates, and freeing capital.

Smart grocery inventory management software isn’t optional for startups that want to scale their table stakes. The companies that get this right first will win customers, margins, and market share.

Frequently Asked Questions

Budget 15–20% of annual revenue for comprehensive inventory management technology, with typical monthly costs ranging from $175/user for mid-tier solutions to $5,000+ for enterprise platforms. Initial implementation costs typically range from $10,000 to $40,000, depending on complexity; however, ROI periods consistently fall within 6 to 24 months, driven by labor savings and waste reduction.

FIFO (First In, First Out) rotates stock based on arrival order, while FEFO (First Expired, First Out) prioritizes based on actual expiration dates. For perishable goods in grocery delivery, FEFO is crucial because products with the same arrival date may have different expiration dates.

Yes, cloud-based SaaS platforms now provide enterprise-level capabilities at startup-friendly prices. Solutions that offer AI forecasting, real-time tracking, and supplier integration provide startups with the tools to scale efficiently.

Modern systems automate traceability requirements for FDA FSMA Section 204, maintain records of Critical Tracking Events (CTEs), and enable rapid recall responses, simplifying audits and reducing regulatory risk.

Plan 3–6 months for full system deployment for a focused pilot; complex multi-location rollouts commonly require 4–6 months for basics and up to 16–24 weeks or more for full-scale integration and optimization.