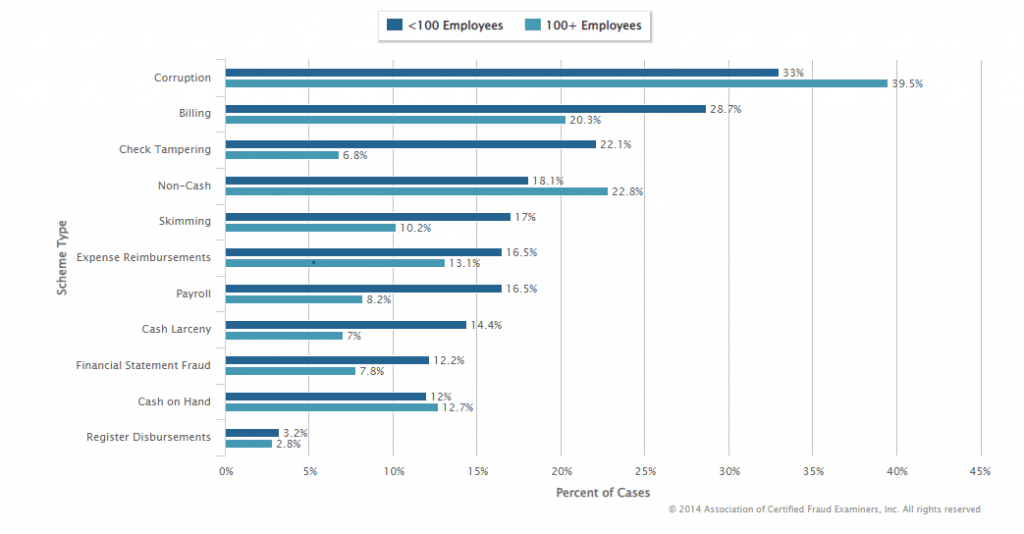

Running a business is not a work of an average Joe. As an entrepreneur, you should be ready for unexpected things to happen, which includes fraud. The large enterprises remain unaffected by the fraud, but SMBs can’t afford to ignore the different types of Ecommerce fraud. However, the ignorance of fraud risk brings loss of $3.7 trillion annually to small companies worldwide.

Recognizing the frauds is all-important to get the business protected from this financial loss that harms the company’s bottom line and reputation.

Here’s The List Of Common Ecommerce Frauds That Business Should Be Aware Of.

Payroll fraud

There are various ways in which employees can fraud the company. They can tell lie about their working hours to increase pay scale or high productivity. They can ask for payment in advance and don’t repay the amount. They can cheat by getting co-workers clock in when they are away from the office.

Solution: Perform employees’ background checking when they are hired. The regular audit of payroll accounts helps in detecting fraudulent activities in the payroll ahead of the time. SaaS payroll services helps a ton in approving payroll before its approved for employees’ wages and tracking timesheets.

Identity fraud

This type of theft costs huge sum of loss to the company. Fraudsters can steal your business identity and get access to financial statements or tax identification numbers from the office’s computer. The lost employees’ paycheck exposes the business bank account number and routing details that bring monetary loss to the company.

Solution: The sensitive data should be kept secured. The hard copies are kept secure by storing them at safe places such as lockers or cabinets. The soft copies are saved by making usernames and passwords difficult and keeping an eagle eye on malware attacks. The harm caused by lost paycheck details is prevented by separating the payroll account from the business account. Also, opting for direct deposit to an employee’s account help in keeping sensitive information safe.

Invoice fraud

The employees create fake invoices to take undue advantage of the company’s money is termed as invoice fraud. It’s like raising the invoice for working hours during which they have never worked for the company and tried to fool the company.

Solution: The company should either manually or automatically via software get the invoice cross-checked for the invoices raised for the timesheet or products/services purchased. The background check of suppliers also helps.

Asset fraud

Asset misappropriation is easy to detect such as manipulation in accounts, missing inventory, forged checks, and much more. the businesses may become prey to skimming activities wherein the employee takeaway cash from the customers or companies without showing any transaction on record.

Solution: don’t put all the eggs in one basket. The cash handling staff must be rotated so that you don’t need to entrust the complete financial risk to one employee.

Read More: 5 Best Ways Mobile Apps Help Fashion Brands and Consumers

Financial fraud

It involves dodging the facts and figures of sales, revenues, or liabilities to manipulate stocks, trick investor, or increase bonus.

Solution: Various accounting functions must be delegated to different employees. Also, financial statements should be closely investigated to identify inconsistencies or impreciseness.

Return fraud

The small online stores selling the tangible products online, they experience return frauds more often. There are different ways customers do the return frauds. Some customers purchase products and after delivery tell the company that nothing was delivered in the Ecommerce package. Some of them purchase and use the product, and then return it. Some customers fraud the company by exchanging the product with a cheap product and then return it. It hurts the business profits, which needs to be removed. However, it can’t be removed entirely but is limited through policies.

Solution: It can be prevented by mandating receipt requirement for product returns. Change the policies of crediting amount only when the product is returned and verified by the seller. Tell the customer to take a video at the time of opening the package so that what’s delivered in the package is verified.

Worker compensation fraud

The businesses having employees experience worker compensation fraud wherein different states have worker’s compensation policies that provide compensation to the employees when they get ill or injured at work. Here, the employees may get injury outside the business and say it all happened when they are at work. Preventing worker compensation fraud is all-important to avoid business financial losses.

Solution: Documenting the health records submitted by the workers, verifying the accuracy levels, and checking the injuries too. Also, a committee is set up that performs worker compensation verification.

Tax fraud

Tax evasion happens when a company’s or individual’s earnings or expenses are reported wrongly. It includes showing lower income to take undue advantage of special exemptions and lower tax brackets. It put a business at risk when a tax audit identifies such misreporting and the company has to pay heavy penalties.

Solution: File the tax accurately and on time without showcasing higher or lower expenses than the actual expenses.

Read more: Enterprise Software Applications That Can Enhance your Business

Banking fraud

Under worker’s compensation policy, the insurance companies need to compensate against the claims submitted by the employees. some employees try to trick the companies and make a profit out of the companies by lying about the injury. It results in higher premiums that hurts the business’ bottom line.

Solution: You can avoid being stringent during the claim adjustment. All the documents must be cross-checked to prevent claim falsification.

Bribery and corruption

It happens in small organizations where some employees bribe to manipulate company contracts or major decisions just to favor some people. Getting kickbacks or skimming from projects are not good for the company’s health.

Solution: Incorporate strict compliance programs and guidelines so that no employee, management personnel, or third-party vendor can attempt to do so.

Conclusion

Irrespective of the industry niche, the businesses are vulnerable to fraud when they don’t know how their employees or customers can fraud the company. The list of frauds helps them to take necessary actions and make efforts to reduce fraud risk and financial losses to the company. If there’s any type of Ecommerce fraud missing on the chart, please let us know in the comments below. We would love to hear and share in our next blog.